The Conveyancing industry is preparing itself for a drop in first homebuyers compared to years past, after Australia faced a second hike in interest rates last week, with additional plans for continued growth into 2023.

The Reserve Bank of Australia (RBA) continued its attempt to limit inflation last week after hiking 50 basis points, rising the total interest rate to 0.85 per cent, on June 7.

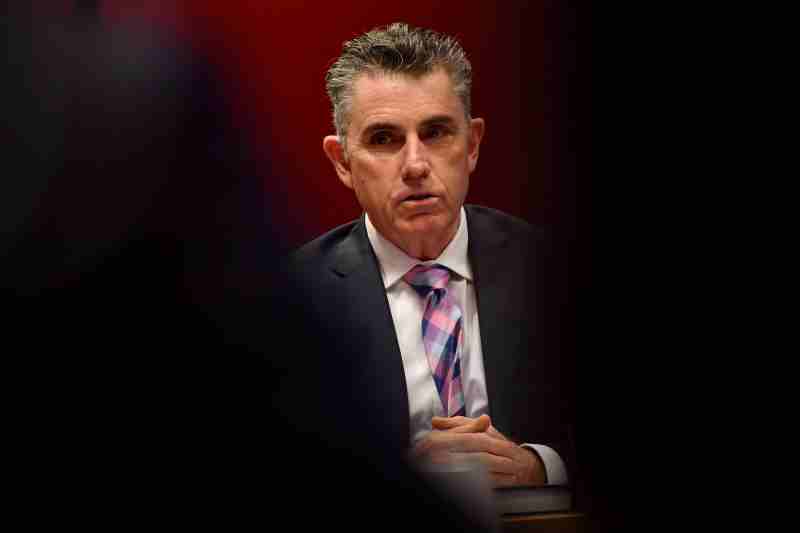

Unfortunately for first homebuyers, this could continue through to 2023 with RBA governor Philip Lowe warning rates will keep raising until inflation starts to fall within its two to three per cent target range.

“Inflation is expected to increase further, but then decline back towards the 2–3 per cent range next year. Higher prices for electricity and gas and recent increases in petrol prices mean that, in the near term, inflation is likely to be higher than was expected a month ago,” Lowe said.

According to ABC News, if banks pass on the rise in full, it will add $133 a month on a loan worth $500,000 over 25 years, and $265 a month on a loan worth $1 million.

The recently elected Labor Government announced plans to help first homebuyers but is yet to deliver its first Federal Budget.

Meaning the conveyancing industry is left on a ledge, waiting to hear if affordability for young and low to middle income Australians will be able to break into the market.

Australian property market drops 0.11 per cent

It’s certainly been an expensive proposition to purchase property for the first time in Australia, especially throughout the last two years of a booming market.

The nation’s first homebuyers have seen a glimpse of affordability in Australia after the market dropped 0.11 per cent nationwide thanks to the second rate rise.

It would be a positive sign for the conveyancing industry if this trend continued, offering a less inflated market value for homebuyers.

However, PropTrack economist Paul Ryan, told news.com.au, this was likely a coincidence, and sited that house prices will continue to grow in 2022, albeit, at a slower rate than the last two years.

Ryan said: “We’re likely to see continued slow growth in housing prices as the cash rate increases.

“It normally takes a little while for interest rate rises to start to affect (house) prices.

“I think, while it’s correlated, it’s more coincidental that we saw these first housing price falls in May, right after the RBA raised rates for the first time in over a decade.”

What the rate rise means for mortgages

News.com.au explained the RBA’s second rate hike in as many months is expected to add about $133 a month to the cost of the average Aussie mortgage.

Tuesday’s rate rise came after the RBA hiked the cash rate from a record-low 0.1 per cent to 0.35 per cent in May, in what was the first rise since 2010.

Under RateCity’s calculations, if the owner-occupier paying principal and interest with 25 years remaining, the June rise would add $80 to monthly repayments of a $300,000 loan, $106 for a $400,000 loan and $159 for a $600,000 loan.

For a $750,000 loan, it would add $199 to repayments and for a $1 million loan, $265.

Affordability for first-home buyers

Regardless of the turbulent property market prices we’ve seen in the past two years, the ability for first homebuyers to enter the market will ultimately come down to borrowing capacity and mortgage repayment affordability.

Which, if the market continues to grow, both will be significantly affected. According to reports from news.com.au, banks are predicting rates to finish the year between 1.5 per cent and 1.75 per cent.

However, financial market pricings are predicting figures closer to more than 2.5 per cent.

“That (2.5 per cent) would imply that the RBA is going to raise rates at every single meeting for the rest of the year, if they go by 25 basis point increments,” Ryan told to news.com.au.

“The difference between those two figures, that’s the thing that really matters for house prices.

“If we have the cash rate going up by another 2 percentage points (to over 2.5 per cent) then that would increase mortgage repayments by about 24 per cent.”

Conveyancing Industry to remain resilient

Ultimately, as a result of the rising interest rates, increases in mortgage repayments and Australia’s current inflation crisis, the conveyancing industry should expect to see fewer first homebuyers and an overall drop in conveyancing matters in the 2022-23 financial year than in year’s prior.

However, if history has anything to say, Australians will continue to invest in property as seen in early 2010’s when interest rates fluctuated around six per cent.

Therefore, the conveyancing industry will continue to display the resilience it has shown throughout the COVID-19 pandemic.

Furthermore, a slight dip in conveyancing matters presents an opportunity for practices to strengthen other areas of business, including efficiencies, technology solution, workflows, and overall offering.

triSearch launched its all-in-one conveyancing solution in September, 2021, offering a premium software and integrated search solution for $0.

With triConvey, you can save you up-to 3.7hours per matter, significantly reduce your time having to rekey matter details, and offers opportunities to switch to a completely paperless conveyance, with integrations to an entire suite of eConveyancing tools.

To learn more about triConvey, book a free demonstration today.