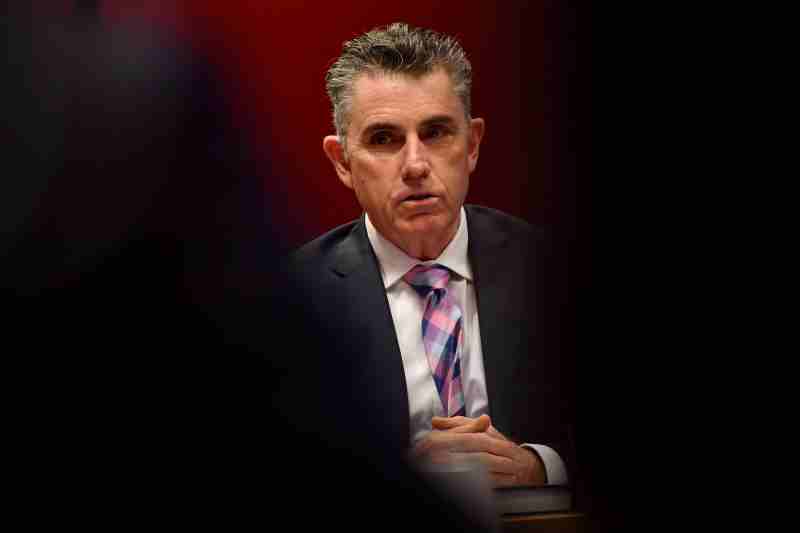

Conveyancers will have to wait a little longer to see what direction their industry will turn after the Governor of the Reserve Bank of Australia Philip Lowe told the National Press Club it is “a plausible scenario” for a cash rate increase in 2022.

Addressing the media on Wednesday, Mr Lowe said the RBA Board was “prepared to be patient”, wanting to see how employment and inflation reacts throughout the year.

Lowe said: “I can say that the faster rate to full employment and inflation consistent with the target does bring forward the timing of a likely cash rate increase. We should welcome that.

“Whether it happens this year or not remains to be determined.”

Conveyancers should expect to see their clients’ borrowing power greatly affected if the RBA determines the economy withstands the “uncertainties” of 2022.

“If things go well, and the economy performs strongly, then there are clearly scenarios where we would be increasing rates later this year if some of the uncertainties are resolved in the way that I hope that they would,” Lowe said.

“But time will tell.”

When asked by press if the Governor himself had a mortgage or if he would choose a fixed or variable loan at the moment, he laughed and denied having thought about what he’d choose.

He then responded: “The advice that I would give to people is – make sure that you have buffers. Interest rates will go up.

And the stronger the economy, the better progress on unemployment the faster and the sooner the increase in interest rates will be.

“One of the things that I think will happen is that interest rates will go up. I can’t tell you when, but they will go up.”

As reported by 9news.com.au, currently, Australia’s cash rate target is 0.10 per cent, the lowest interest rate on record.

If interest rates were to be hiked multiple times in 2022, the maximum borrowing capacity of Australians would be slashed by tens of thousands of dollars.

The news report explain that based on a single person taking out a 30-year loan, a person earning $100,000 a year would see their maximum borrowing capacity fall by $31,900 to around $719,100.

It is now a matter of when it will happen, not if, and conveyancers should be ready to handle the change in financial scenarios for their clients.

One important tool to helping any future unknown scenarios is to use the latest in live update Settlement Adjustments.

With triConvey integrations with the Office 365 suite, conveyancers can make live adjustments which capture in both the document and matter card.

In addition, triConvey is also equipped with a built-in adjustments calculator helping you calculate your adjustments, amounts required to settle, reconciliation and create your cheque directions with ease as they are fully automated.

To learn more, book a free demonstration today.