A UK property cyberattack on a major UK legal managed services company in late November brought property sales to a standstill for up to 200 real estate agencies.

While there was no evidence that clients’ personal data has been compromised, the disruption has destabilised the market and caused reputational damage to the company, CTS.

The incident occurred on November 24 and as of December 12, the company was still working to resolve the issues.

The incident is being scrutinised globally, highlighting the need to further tighten data security. Australian Conveyancer asked two industry experts this month’s burning question . . .

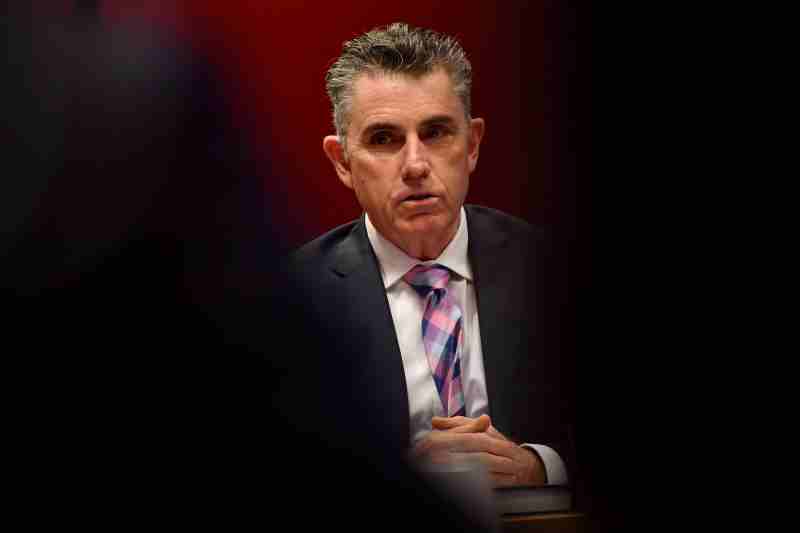

FROM Chris Gibbs, triSearch, CEO

Australian property conveyancers are served by similar managed legal service providers including triSearch Australia.

Their market leading solution known as triConvey is a cloud-based practice management solution built for conveyancers providing users access to an integrated software, search and conveyancing tools platform.

triSearch chief executive officer, Chris Gibbs said that “as the sophistication and scale of cyberattacks increases a prevention-only response is no longer enough.

“Businesses should assume a cybersecurity attack will happen and by focusing on early detection and response planning businesses can be more resilient to an attack.

“The more prepared we are as a business for an attack the quicker we can bounce back and protect the interests of conveyancers, lawyers, home owners, and buyers”, Mr Gibbs said.

In early November, Sydney-based data security strategist and consultant Shameela Gonzalez told Australian Conveyancer that it was more a case of when not if a cyberattack attempt is made on the industry.

FROM Shameela Gonzalez, CyberCX, Director

As transactions involve property and family trust funds, the stakes are high. A director of security specialist CyberCX, Gonzalez said:

“In our world we talk about high-value targets. From a conveyancer point of view, one thing a criminal will consider is who are the Australians that are financially better off? What post code do they live in? What are their mortgages? The property they are buying.

“That information becomes really lucrative for cybercriminals to then go and exploit an individual or on-sell to the information to other criminals.”

Meanwhile, a December 8 statement on the CTS website in the United Kingdom read:

“CTS recently experienced a cyber incident which impacted a portion of the services we deliver to some of our clients.

“Since then, we have been working around the clock with the assistance of third-party experts to resolve this matter.

“At the outset, we established a four-phased plan which would enable us to restore client services as safely as possible. We have successfully completed phases 1-3 and are now at phase 4, which is the restoration of client environments. Phase 4 is a complex exercise and may take some time.

“We remain in contact with our clients and are keeping them informed as we progress through this final phase,” the statement said.

For news and insights from experts around the industry, download edition four of the Australian Conveyancer, today.