On its website, fast-growing conveyancing team Dott & Crossitt is quick to qualify its company name.

“There are no names on the door here. Dott & Crossitt aren’t people, but an ethos of how we work side by side with our clients to make the process of buying and selling a property smooth, efficient, and uncomplicated.”

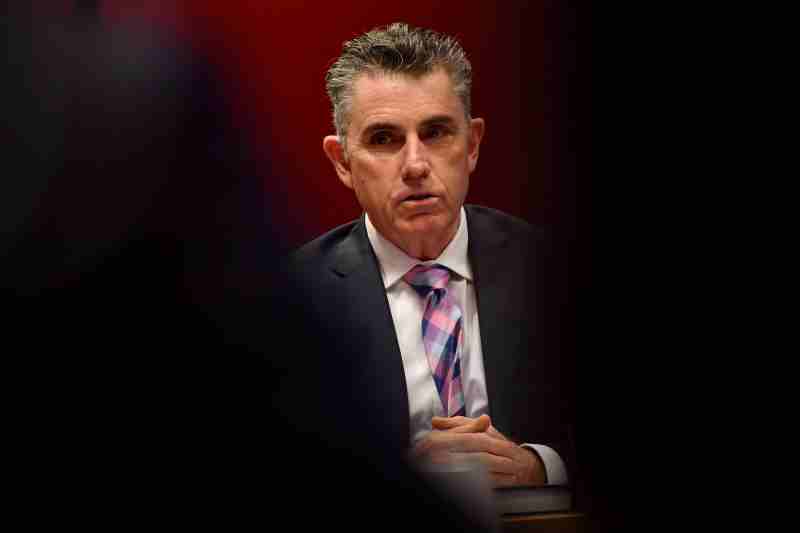

Principal solicitor Jared Zak founded the business in 2014 after careers in law and finance in Japan, London, and Sydney.

The operation has been on an upward trajectory ever since. Confident, collaborative, positive, and no nonsense: the words aptly describe both Dott & Crossitt and the man behind it.

Australian Conveyancer magazine sat down with Jared Zak late in November, at a time when most businesses were beginning their wind-down to Christmas.

Most … but apparently not so slow for the conveyancing industry. Against a current of successive home loan interest rate rises, soaring cost-of-living expenses and sky-high housing prices, conveyancers had been busier than ever.

The D&C boss put context around the perfect storm in property circles.

AUSTRALIAN CONVEYANCER: Jared, thanks very much for joining us – it’s a busy time for you. I understand your business has doubled its search transactions in the past year. It’s a rapid rise from where you started your business. we’ll unpack that journey but firstly, what brought you to where you are now?

JARED ZAK:

So, when I left law school in Sydney, I did what I thought I had to do, which was to get into the big firms.

Then once I got there, I did the things that again, I thought I had to, which was to move to London, and work for magic circle firms.

I then spend the next six or seven years working in one of the most prestigious firms in the world – but just absolutely hating life, just sitting in front of a desktop computer, just effectively proofreading prospectuses.

Although I was working on some amazing deals, I was not learning much at all. It took a little while to realise it was a bit of a trap.

I was a small cog in a big wheel by the end of my time in London. I said at the time to my ex-wife, that when I come back, I want to do my own thing.

I want to do something basic, but I want to do it really, really well. My ex didn’t like that idea so much, particularly in the first couple of years.

AC: Was it because of a lack of security?

JZ:

Exactly, when you’re starting off a law firm, particularly conveyancing. The initial idea was not to do conveyancing, it was just to do something general, maybe a suburban practice, but to do it well, with a focus on customer service and perhaps with a focus on IT.

Back then, when PEXA was on the horizon but to do deals, I could see something was going to change there and I wanted to be a part of it. But you can’t make money doing just six or seven conveyancing matters per month.

It was hard going, and we didn’t have any staff. I just sort of stuck to it and after two or three years, the penny dropped and thought ‘there is something in this’. If I just commit fully to conveyancing and focus just on this thing called PEXA or Sympli, and the idea that everything’s going to be electronic.

It was in about 2015-2016, where we said ‘no’ to other legal work and just focussed on conveyancing.

AC: That was a transition? It wasn’t jumping straight in?

JZ:

Absolutely. We were a generalist practice doing business sales, leasing, all that kind of stuff, and some of it was profitable, but also very demanding of my time, I couldn’t delegate it.

So, with some reluctance, I said no to that, and then we got into the conveyancing business. And this week (late November) was our busiest ever settlement week (120 settlements in a single week). Back in those early days, I remember 20 a month was my first goal.

And then five or six years we’re now starting to be what I thought the business could be, which is great.

AC: What was the vision going in? Describe that moment in your life where you went “I think this is going to be it?”

JZ:

It is encapsulated in the name, which is a bit of a silly one. But ‘Dott and Crossitt’ the idea is dotting the Is and crossing the Ts.

We are serious about what we do but we also don’t take ourselves too seriously, and that’s one of the principles that guides us.

We are approachable, we’re not this stuffy old law firm that pretends everything’s the Magna Carta or overly complicated.

We are modern, we like to embrace technology, and use it where we can. So that was some of the ethos. There were heaps of businesses that were innovating and disrupting at the time, tackling things differently and efficiently.

AC: Businesses outside of the legal fraternity?

JZ:

Yeah. I think if you go back 10 years, Uber was just changing the way that yellow taxis were done, so I guess that there was some inspiration from those types of approaches. Airbnb too.

AC: Did you make a conscious effort to review other business practices? You just mentioned Uber as a broad example, but did you examine other businesses, and think: “I could take that idea?”

JZ:

Not particularly. I mean, I did take a lot from PEXA, just culturally and how they went from being a start-up. PEXA allowed me to study them a bit, but I can’t think of too many others.

AC: So, that early vision was “We’ll see where this goes”? Did you have something specific in mind when you first started Dott and Crossitt?

JZ:

It sounded stupid at the time, but we wanted to be the biggest conveyancing firm in Australia. That was the goal.

AC: Why did you think that was stupid?

JZ:

Well, we’d be literally doing seven settlements a month. I had a business coach at the time, and he got me inspired and said: “If you do all this right, there’s no reason why you can’t be (the biggest conveyancing firm)”. And I wrote it down. I think I probably only half believed it, but it’s now realistic.

AC: That’s good. So, your business has grown quite incredibly in the past ten years. We’ve talked about roadblocks or speed bumps; can you describe some highlights in your journey?

JZ:

Almost every time before we proceeded a growth phase, we’ve almost always taken a leap of faith. You think we’re just about to grab a whole lot of additional market share or there’s something about to come online.

Almost every time I’ve had that uncomfortable feeling in my stomach, knowing something was the right move but was also terrifying [it normally was normally followed by huge growth].

Compared to this time last year, we are so much busier now, and the biggest thing that has changed is correction in the market. Every time we have a correction, we always emerge with a heap more market share. It’s phenomenal.

AC: You were saying how busy you were right now, which sounds like the property industry has gone mad. Tell us about the impact on your business specifically.

JZ:

The last few months have been just Goldilocks conditions. And it’s not just me saying that. I sit in meetings with sales agents every Monday, and for the past few months they say, “You have never seen, and will probably never see better market conditions than right now.”

There are currently lots of buyers, lots of stock in the local market, and prices are still high. All these elements usually never happen at the same time.

Prices are probably about to correct if they haven’t already started correcting, but the volume is still there. The ultimate message the agents are getting from principals, which is the takeaway, is that this is not going to last.

“We have done a lot of work to custom build our CRM, and just focusing on the marketing of our company and hiring the best people we can find.”

AC: What do you change in your business during this busy period?

JZ:

While the money’s there, cash flow has been good, we’ve been diligent in trying to reinvest it back into technology.

We have done a lot of work to custom build our CRM, and just focusing on the marketing of our company and hiring the best people we can find.

AC: How do you mitigate against any potential losses down the track if the market changes?

JZ:

By making sure we are putting money away for a rainy day and not going too crazy either.

I had an opportunity to lease some nice premises recently, and in terms of rental, now’s the time because we’re well established and it’s nice to have nice headquarters, but I guess it was that voice in the back of my head that just said: Is this the right time to be doing this?

But what is it going to look like in six months if the market corrects? Because I’ll be paying that premium rent.

So that was one those things that I passed on.

AC: You were talking about technology, and I understand that you use numerous platforms to conduct searches, triSearch being one. Do you use other similar platforms like do some of the council searches?

JZ:

There’s nothing out there that integrates directly to our invoicing, that’s the best thing about triSearch.

There’s a lot of veteran conveyancers who still like doing manual searches. But this can cost the offices $100 per matter because of the time it takes to fill out the forms, chase up council.

I think one of the challenges is just getting people to embrace new systems.

AC: Tell us about your foray into to Western Australia. The different jurisdictions, state by state, and different ways of doing things. Ultimately, you’d have to think there must be efficiency in a common national approach.

JZ:

Unfortunately, I don’t see it happening. It’s not on the agenda anywhere.

NSW is the most litigious and most disclosure-heavy regime, and a lot of agents and clients complain about that and say “why have these contracts this thick in NSW? I bought a property last year in Queensland using a contract of 20 pages.”

There is a tendency from industry groups like the REI to say let’s try and pare it back and get the agents to start having more control with the contracts.

Let’s de-lawyer it all. From a consumer perspective, I see some sense in it, but it looks like there will be opposition.

Queensland have now introduced a new disclosure statement. It’s going to be more like New South Wales, more disclosure up front, which is probably going to be more lawyer involvement upfront.

AC: You’ve recently started doing matters in Western Australia. What’s that journey been like in the context of what we have just spoken about?

JZ:

That is literally the Wild West. Over there, it’s more market driven by so-called settlement agents.

They are still lawyers but that’s sort of the market. You talk about the focus on lawyers in NSW, but in Queensland, the lawyers are taking the backseat.

They normally only get the contract after its exchange. The conveyancing process in Queensland from a lawyer’s perspective is sometimes described as a ‘rescue mission’.

Then you go to WA and its effective, there are no lawyers. You can have a whole transaction where you’re not dealing with lawyers, you’re dealing with settlement agents. It’s very different. It’s closer to Queensland. There is not much disclosure, there’s a lot of conditionality.

AC: How is the demand tracking within the business?

JZ:

It’s huge. In terms our own business, were doing probably about four or five times as many in WA as we were five months ago. The buyers’ agents are saying to Sydney and Queensland buyers “look, why don’t you have a look at Perth?” encouraging them to buy off the plan, and house and land packages in WA where there’s better value for money.

AC: Have you considered frontiers like South Australia or something like that?

JZ: I think ideally, we would do South Australia. My preference would be to really consolidate on WA and Queensland first.

We had not planned to take on WA, but people kept asking me “Can you do WA?”, and then I finally said, “let’s do it” … and the floodgates opened.

For news and insights from experts around the industry, download edition five of the Australian Conveyancer, today.