By: Poppy Johnston and Andrew Brown

Weaker sales figures in the retail figures are a warning sign ahead of national growth figures, the treasurer says.

The treasurer has foreshadowed a weak end to the year for the national economy, saying warning signs were present in the retail sector.

National growth figures for the December quarter will be released on Wednesday, with some predicting GDP to have gone backwards for the last three months of 2023.

Economists expect a subdued read for the December quarter, especially after business inventories data from the Australian Bureau of Statistics on Monday fell by more than anticipated.

Businesses were found to be running down their inventories over the December quarter, recording a 1.7 per cent fall that was much softer than the flat result economists were predicting.

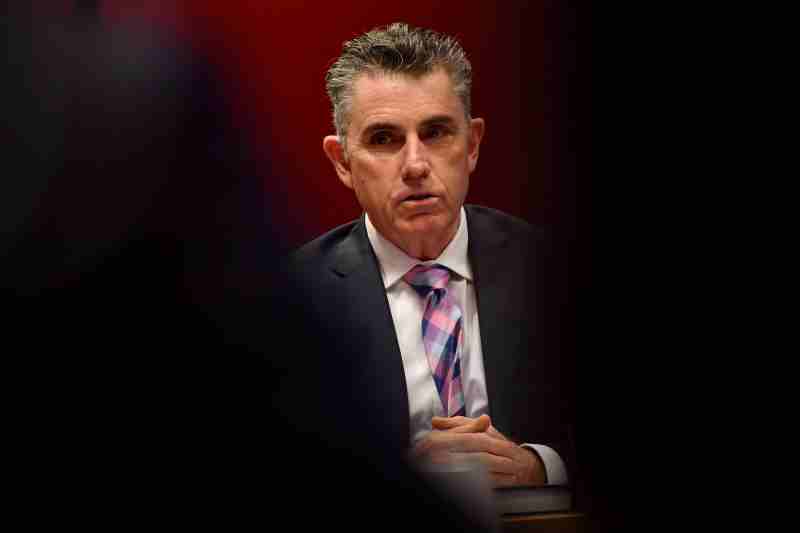

Jim Chalmers said the quarterly results were expected to be weak in line with global trends.

“The December quarter was quite weak because people were running down their inventories rather than producing or acquiring more stock, that is often a bit of a warning sign about the economic conditions at the time,” he told ABC TV on Tuesday.

“There is enough around to trouble us about how the economy finished 2023.”

On Tuesday, economists will get the balance of payments data and government statistics, which will be used to firm up growth forecasts.

Despite the forecasts for the quarter, Dr Chalmers said Australia was in a better position than similar economies, which had gone into recession during the same time period.

“The December quarter in the Australian economy and indeed the global economy was quite weak. Remember, that was the quarter where we saw Japan and the UK both go into recession,” he said.

“We had an interest rate hike right in the middle of that December quarter, we had those persistent cost of living pressures that people are confronting in our communities and around our country.”

Pockets of the economy are proving resilient and even showing signs of recovery.

An index sampling activity in the services sector points to a resurgence in early 2024 led by new orders, especially in finance and insurance.

The final Judo Bank services business activity index rose to 53.1 in February, up from 49.1 in January and into the above-50 range that indicates an expansion on the month before.

Judo Bank economist Matthew De Pasquale said the purchasing managers index result reflected a domestic services sector that had moved beyond the anticipated soft landing phase and entered a recovery phase.

Though a win for economic growth and employment, he said it could have implications for interest rate settings.

“With the resurgence in activity comes the question of domestic services inflation and whether it will remain in gradual decline along the RBA’s narrow path,” Mr De Pasquale said.

Consumer confidence has also been trending higher of late though it did dip back to its lowest level all year last week.

The ANZ and Roy Morgan consumer sentiment survey fell 2.2 points last week, which senior economist at the bank, Adelaide Timbrell, said may have been influenced by weak retail sales figures.

“Confidence among those paying off their homes is still trending up, but renter and outright owner confidence is down,” she said.