Australia’s AML/CTF Amendment Act 2024 expands anti money laundering and terrorism financing obligations to a new group of non-financial businesses and professions, collectively known as “Tranche 2 entities”.

From 1 July 2026, the reforms will apply to professions like real estate professionals, lawyers, conveyancers, accountants, trust and company service providers, and dealers in precious stones, metals and jewellery.

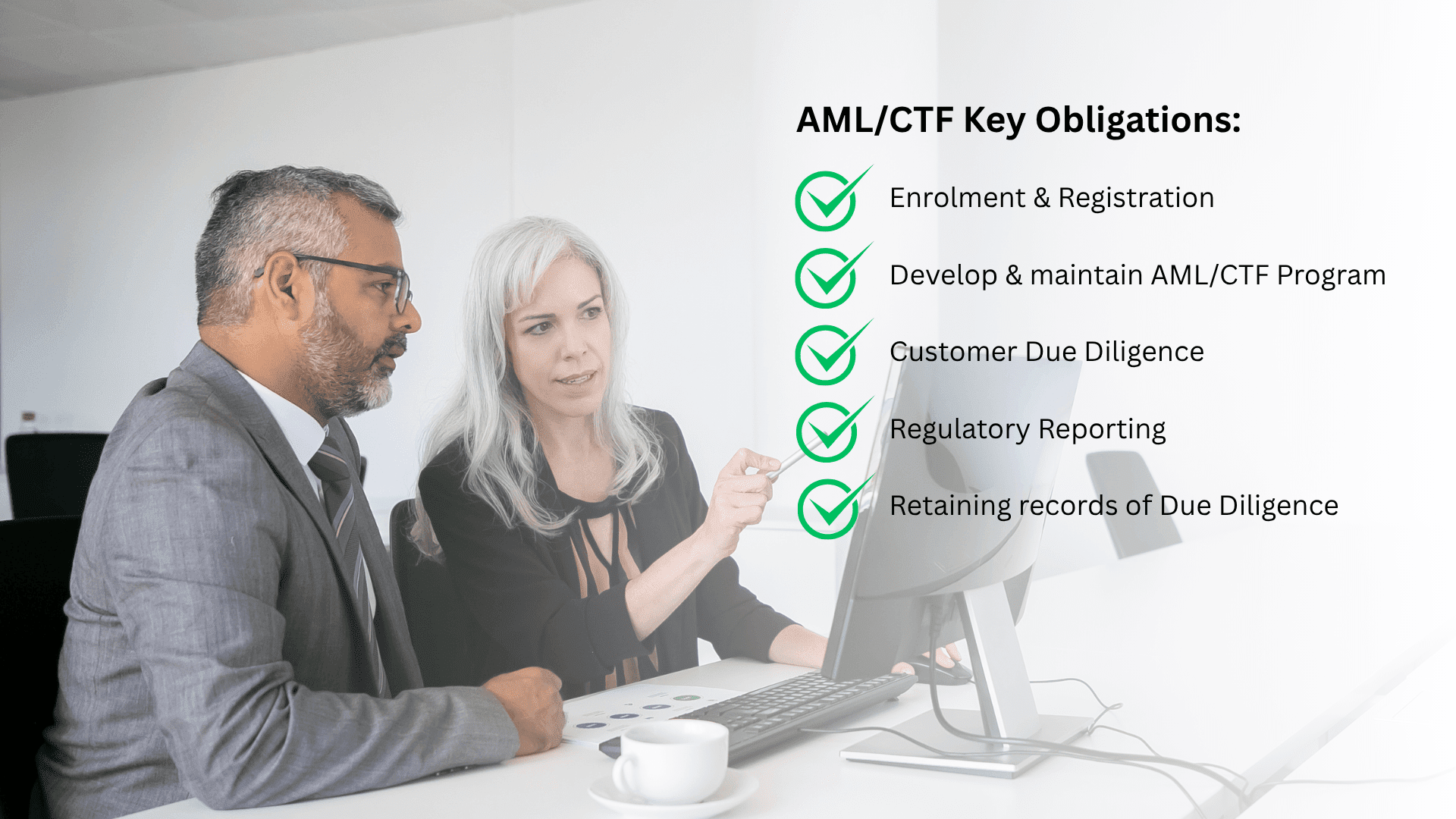

Key Obligations for Tranche 2 Entities

Tranche 2 entities must comply with core AML/CTF requirements including:

-

- Enrolment and registration with AUSTRAC within 28 days of providing a designated service, typically by 29 July 2026 for most entities.

-

- Develop and maintain an AML/CTF Program tailored to the business, including risk assessments, policies, systems, controls, annual reviews and independent evaluation every three years.

-

- Customer Due Diligence (CDD), including initial identity verification, ongoing monitoring and enhanced CDD for higher risk clients.

-

- Regulatory reporting, including Suspicious Matter Reports (SMRs), Threshold Transaction Reports (cash ≥ A$10,000), international transfer and cross border currency reports, and annual compliance reporting.

-

- Records retention of all CDD, transaction logs, training records and compliance documentation for at least 7 years.

AUSTRAC has also outlined regulatory expectations for 2025–26, urging entities to be enrolled, have an AML/CTF compliance officer, deliver staff training, and be prepared for suspicious matter reporting by 1 July 2026.

Non compliance can result in penalties, enforceable undertakings, and reputational harm.

Why invest in solutions now instead of waiting to July 1st 2026?

Many conveyancing firms are asking: Why invest in onboarding technology now instead of waiting until July 2026?

The answer is simple: the sooner you start, the more prepared and protected your business will be. Early adoption of onboarding tools allows you to:

-

- Streamline CDD from day one

-

- Build and test compliance workflows well before the deadline

-

- Train staff and embed AML processes to avoid disruption later

That’s where the triSearch Onboarding & VOI solution comes in. It supports your compliance with:

-

- Digital identity verification (VOI) to securely meet CDD requirements

-

- Integrated AML screening for politically exposed persons (PEPs), sanctions and watchlists

-

- Audit trails and secure record keeping that satisfy the 7 year retention rule

-

- Customisable workflows tailored for conveyancing risk profiles

By using triSearch now, you’ll have the systems, processes and training in place before the AML/CTF regime applies, so you’re not reacting last minute but proactively leading.

Preparing to Stay Compliant and Avoid Risks

What you can do today:

-

- Use AUSTRAC’s “check if you’ll be regulated” tool.

-

- Subscribe to AUSTRAC updates and prepare for registration from 31 March 2026

-

- Start drafting your AML/CTF Program and assign a compliance officer

-

- Implement triSearch Onboarding now so you’re ready to go before Tranche 2 begins

Getting ahead of Tranche 2 isn’t just about avoiding AUSTRAC penalties. It’s about protecting your business, your clients and your reputation from illegitimate dealings. With triSearch Onboarding, you can turn compliance into a strength, not a stress.