The AML/CTF reform is entering a new phase. These changes are designed to strengthen the financial system and reduce the risk of property transactions being used to facilitate money laundering and serious crime.

With key deadlines approaching, now is the time for firms to understand what’s changing, what’s required, and how to prepare.

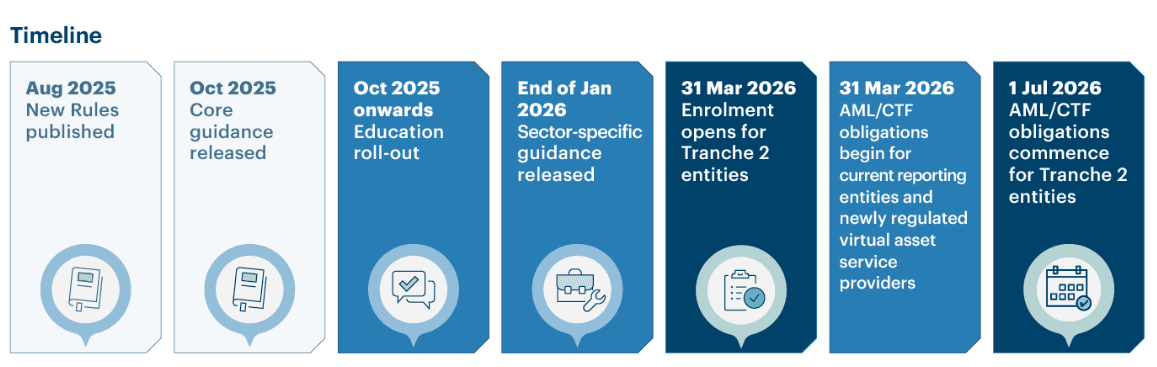

Key dates you need to know

- 31 March 2026: Law firms must enrol with AUSTRAC and begin implementing AML/CTF compliance steps.

- 1 July 2026: Full AML/CTF obligations apply; Tranche 2 regulation formally begins.

The timeline below sets out AUSTRAC’s staged implementation of the AML/CTF regime, beginning with the release of new rules and guidance and continuing through to the full commencement of Tranche 2 obligations.

These milestones provide law firms with clear reference points to plan their compliance approach, prepare internal processes, and ensure their systems are ready. During this period, AUSTRAC will continue publishing guidance and practical resources to support newly regulated entities as they transition.

Understand AML/CTF transitional rules

AUSTRAC is currently finalising transitional rules. These arrangements are intended to give businesses time to update their systems, workflows, and compliance processes, while continuing to effectively identify and manage money laundering and financing risks during the transition.

Some transitional rules include:

- The transitional rules will include a 3 year initial CDD period for existing entities from March 2026 to March 2029.

- New virtual asset services obligations deferred to 1 July 2026.

- Financial advisors new obligations deferred to 1 July 2026.

- All reporting entities must nominate their compliance officer by 30 May 2026.

- International value transfer services reporting deferred until 2029.

- No re-registration is required for existing DCEs, remittance providers or affiliates.

- Current reporting entities can keep using applicable customer identification procedures or move to a new framework. Once switched, you can’t change it.

- Extended windows for independent evaluations are available to those who recently completed a review.

What your firm should focus on now

To prepare for Tranche 2 AML/CTF compliance, firms should understand their obligations under the AML/CTF Act and nominate a Compliance Officer. Review your client onboarding processes, including how to verify identities and maintain records, and ensure your practice management system can capture client information and track matters efficiently. It is also important to stay informed by regularly reviewing AUSTRAC updates and industry guidance as the reforms progress.

How triSearch Compliance Centre can help you meet AML/CTF obligations

As part of our commitment to supporting conveyancers and property lawyers through these reforms, triSearch is introducing the Compliance Centre in March. This all-in-one compliance solution has been built specifically for property professionals and aligns with AUSTRAC’s implementation timeline.

The Compliance Centre provides practical guidance, structured workflows, and ongoing support to help firms meet their obligations confidently with these features:

- Supports the entire compliance lifecycle, including enrolment guidance, firm and staff onboarding, customer KYC and risk assessment, AML reporting, staff training records, audit trails and 7-year record keeping

- Developed with insight from law societies and conveyancing professionals across Australia

- Integrated directly into triConvey

- All data complies with ARNECC and ISO/IEC 27001:2022