Bookkeeping might not be the most thrilling aspect of running a small conveyancing practice, but it’s absolutely crucial for maintaining financial control, ensuring compliance, and fuelling your business growth.

In Australia, where small businesses make up 97.2% of all businesses, sound financial management is more important than ever. The Australian Taxation Office’s latest estimates for the 2021-22 small business income tax gap indicate a net gap of $17.7 billion, or 12.6% – with omitted income and over-claimed deductions being major contributors. This signals the ongoing need for accurate record-keeping and a solid understanding of tax obligations.

Whether you handle your bookkeeping in-house or outsource it to a professional, there are simple steps you can take to streamline your processes and reduce stress at tax time. Below are four essential bookkeeping tips every conveyancer should follow, backed by insights from the ATO.

1. Separate personal and business accounts

Mixing personal and business expenses is one of the most common pitfalls for new business owners. The ATO consistently advises against this practice as it can lead to inaccurate financial records and make it challenging to track business performance.

Keeping your accounts separate helps to:

- Avoid confusion when tracking deductible expenses: This is vital for accurately claiming deductions, which the ATO actively monitors.

- Make your tax preparation quicker and cleaner: Separated accounts directly support clearer reporting for your Business Activity Statements (BAS) and annual tax returns, decreasing the likelihood of errors that can lead to penalties.

- Streamline monthly reporting and cash flow analysis: With distinct accounts, you can get a proper understanding of your business’s financial health which improves your strategic decision-making.

Overall, keeping your personal and business accounts separate makes it easier for you or your bookkeeper to track business expenses, manage invoicing and sales, and save time when paying bills or preparing tax returns.

2. Know what counts as a business expense

Understanding which expenses are tax-deductible is critical for conveyancers, especially with rising business costs. Over-claiming deductions is a common mistake that contributes significantly to the small business tax gap, accounting for approximately 42% of the gap for small companies and 23% for individuals in business.

The ATO has three golden rules for allowable business deductions:

- The expense must relate directly to your business, not personally.

- Only the business-use portion of a mixed-use expense is deductible (e.g., if a car is used for both personal and business travel, only the business percentage can be claimed).

- You must keep documentation to prove the expense. The ATO requires records to be kept for at least five years.

Why it matters: Properly categorising your conveyancing-related expenses (such as software subscriptions, compliance searches, professional indemnity insurance, and office costs) helps maximise legitimate deductions and keeps you “audit-ready.” Accurate expense tracking also supports more reliable forecasting for long-term growth and compliance with record-keeping requirements, which the ATO strongly encourages.

3. Run regular financial reports

Delaying bookkeeping practices is a common mistake that can lead to missed tax deadlines, inaccurate financial reports, and difficulty assessing real-time liquidity. Running regular reports monthly or at least quarterly helps you stay in control of your financial health. The ATO provides resources like the “Cash Flow Kit” to help small businesses better manage their cash flow and meet financial commitments, including tax obligations.

Creating regular reports allows you to:

- Recognise slow-paying clients and cash flow gaps: Proactively identifying outstanding invoices can significantly improve your immediate cash flow.

- Monitor business growth and large outgoings: Regular reporting allows you to track key performance indicators and identify areas where spending needs to be adjusted.

- Get insights for budgeting and strategic planning: With accurate and up-to-date financial data, you can make informed decisions about your practice’s future, whether it’s expanding services or investing in new technology.

These reports ensure your practice is well-prepared for BAS or EOFY obligations, minimising the risk of penalties for late or incorrect lodgements. It also helps you plan for better cash flow in the future.

4. Automate your billing and invoicing

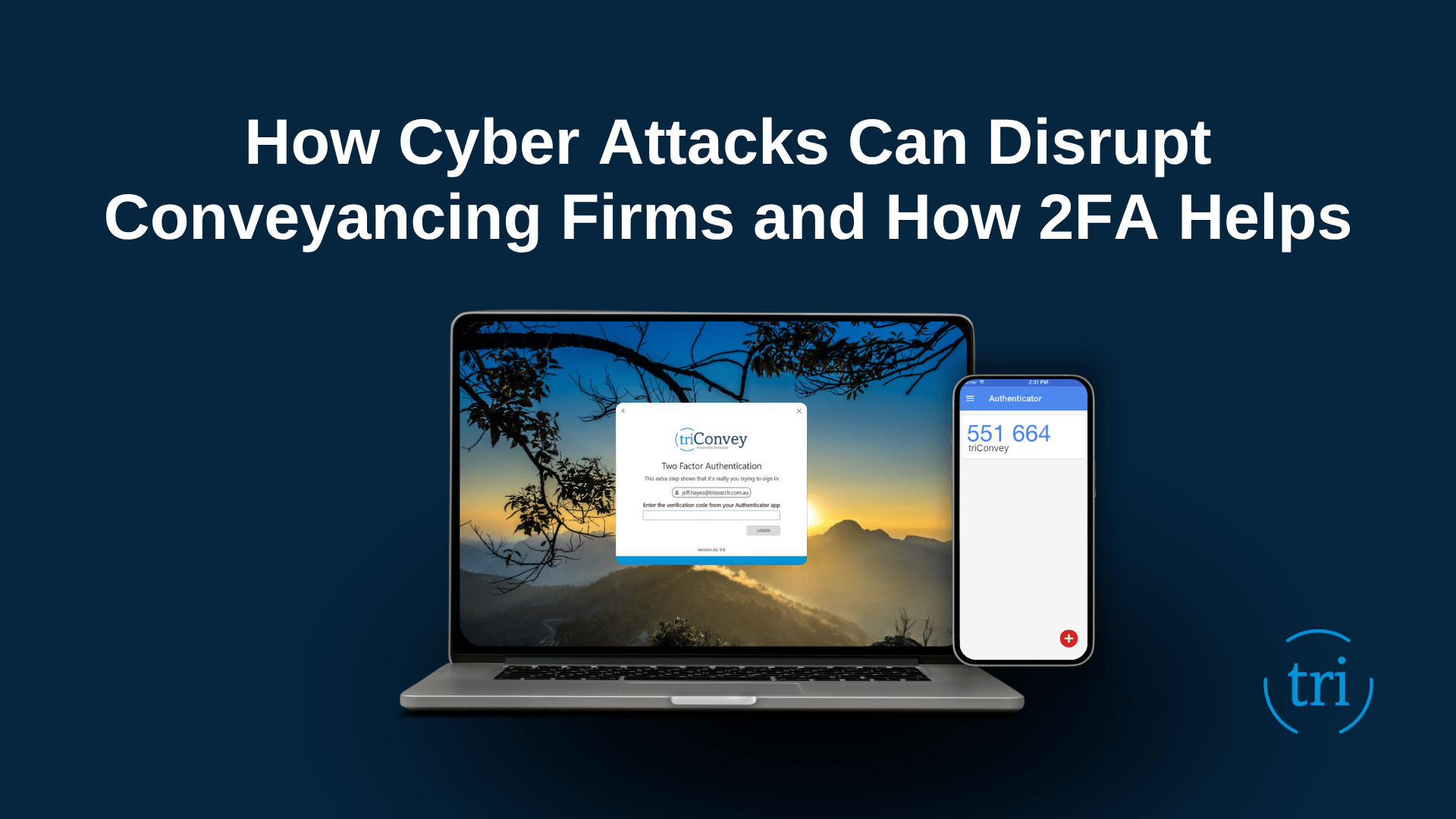

Manual billing processes can lead to missed disbursements, delays in payment, and errors – all of which negatively impact cash flow and can attract ATO attention.

Switching to automated billing and trust accounting tools can help you:

- Capture all chargeable searches and disbursements automatically: This makes sure that no billable item is overlooked, directly boosting your revenue.

- Eliminate double-handling and data entry mistakes: Automation reduces human error, leading to more accurate financial records and less time spent on corrections.

- Send invoices faster and get paid sooner: Timely invoicing is crucial for improving your accounts receivable and maintaining healthy cash flow.

For example, triConvey’s billing and trust accounting tool can be used to record your compliance costs and VOI searches are captured accurately. This significantly decreases administrative time while improving your cashflow.

Good bookkeeping is good business

Strong financial systems are the foundation of any successful conveyancing firm. The ATO often highlights that businesses with “good record keeping” and “effective use of technology to manage their business” are more likely to report correctly. By separating accounts, understanding your deductions, running consistent reports, and automating your billing, you’ll spend less time chasing paperwork and more time focused on growing your practice, all while staying in the ATO’s good books.