To reduce the risk of identity fraud and fraudulent property transactions, verifying a client’s identity is part of the everyday due diligence required of conveyancing professionals, but is made easy with VOI technology.

But the manual processes involved in identity verification can take up a lot of valuable time and effort including arranging in-person meetings, obtaining signatures and scanning and filing documents.

So, at a time when eConveyancing is making property transactions faster, safer and more efficient, it makes sense that Verification of Identity (VOI) technology is becoming increasingly important for conveyancers looking to deliver the best services to clients.

Just like eConveyancing reduces client meetings and removes the need to attend a settlement or speak to banks in person, VOI technology means you can also verify a client’s identity remotely without them being present.

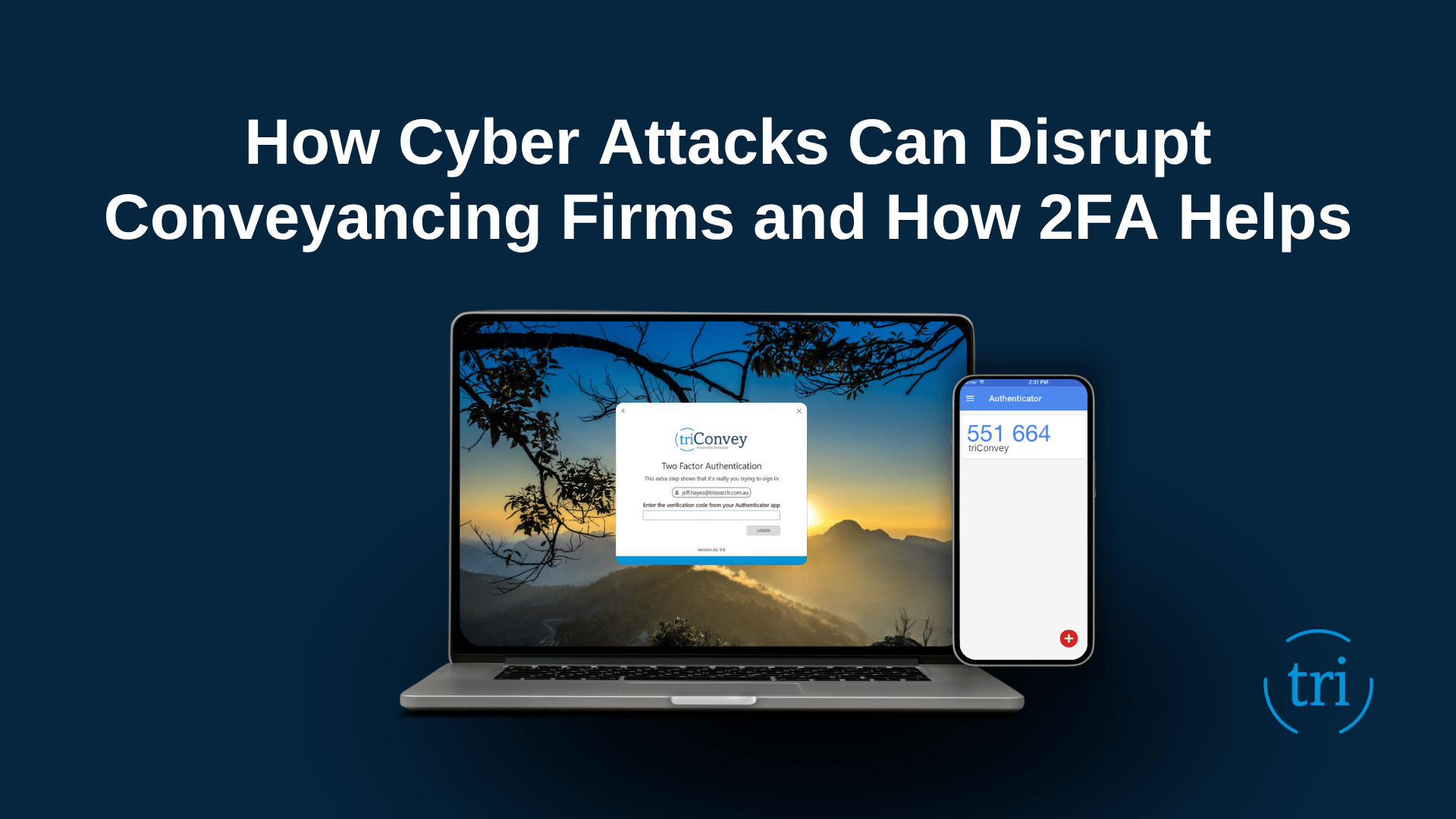

Securely verifying your clients’ identity is easy with our triVOI mobile app, which can be downloaded via the App Store or Google Play. Simply, triVOIs built-in workflow will guide you through all the required verification of identity documents which you’ll upload to your client’s profile along with a signed declaration, before ordering your VOI report.

Helps speed up transactions

How you decide to verify your client’s identity is up to you – provided you take reasonable steps to prove identity as set out by the ARNECC Model Participation Rules. But, by taking control of your VOI requirements and eliminating manual and physical processes, you’ll be able to move faster on transactions.

For example, even if you use a third party VOI Agent, an app such as triVOI means you can seek documentation and (directly) request the verification you need to get the ball rolling straight away. What’s more, you could use triVOI to verify your clients’ identity from the comfort of your office or while you’re on the road to keep things moving during busy times.

triVOI can also be integrated into practice management software so you have immediate access to digital documents as you progress through the workflow.

Meanwhile, uploading VOI at the time of e-settlement will be as easy as dragging and dropping the file.

Lowers the cost of disbursements

During the conveyancing process, costs can mount in all sorts of ways whether it’s using your own professional time or incurring additional fees.

So, arranging to formally verify your clients’ identity documents in person or using an agent can be two of the least cost-effective ways to conduct a VOI. By simply uploading all the relevant documents to the triVOI app, you can quickly obtain verification for less than $10.

More organised and offers peace of mind around security and privacy

You’ll be able to say goodbye to photocopies and lever arch files. All your clients’ stored documents will be easily accessible on the triVOI platform with quick summary screens to help you navigate your historical verifications.

You can also rest assured that none of your clients’ documents will be stored on your device either, which means data is encrypted and kept safe and secure from security breaches.

What’s more, secure sign in requirements will prevent unauthorised access to client information and VOI reports.

It’s up to you to decide how you will meet your verification of identity requirements, but when it comes to embracing digital transformation it could make perfect sense to take a more holistic approach.

With eConveyancing becoming common practice around most of Australia, VOI technology will be a key component to ensuring your business offers an all-round efficient and consistent experience from start to finish.